EMQQ Global January 2024 Performance Overview

- The EMQQ Index declined 6.6%

- The FMQQ Index fell 2.3%

- The INQQ Index rose 2.2%

The leading positive contributors to performance for the EMQQ Index were India-based Reliance Industries and Latin America’s Mercadolibre, posting gains of 10.6% and 8.9%, respectively. The former got a boost from a strong set of recent quarterly results, in which operating profits increased nearly 17%. Meanwhile, Mercadolibre benefited from a series of increased price targets from analysts on the back of continued strong execution in Latin America’s e-commerce and fintech markets.1

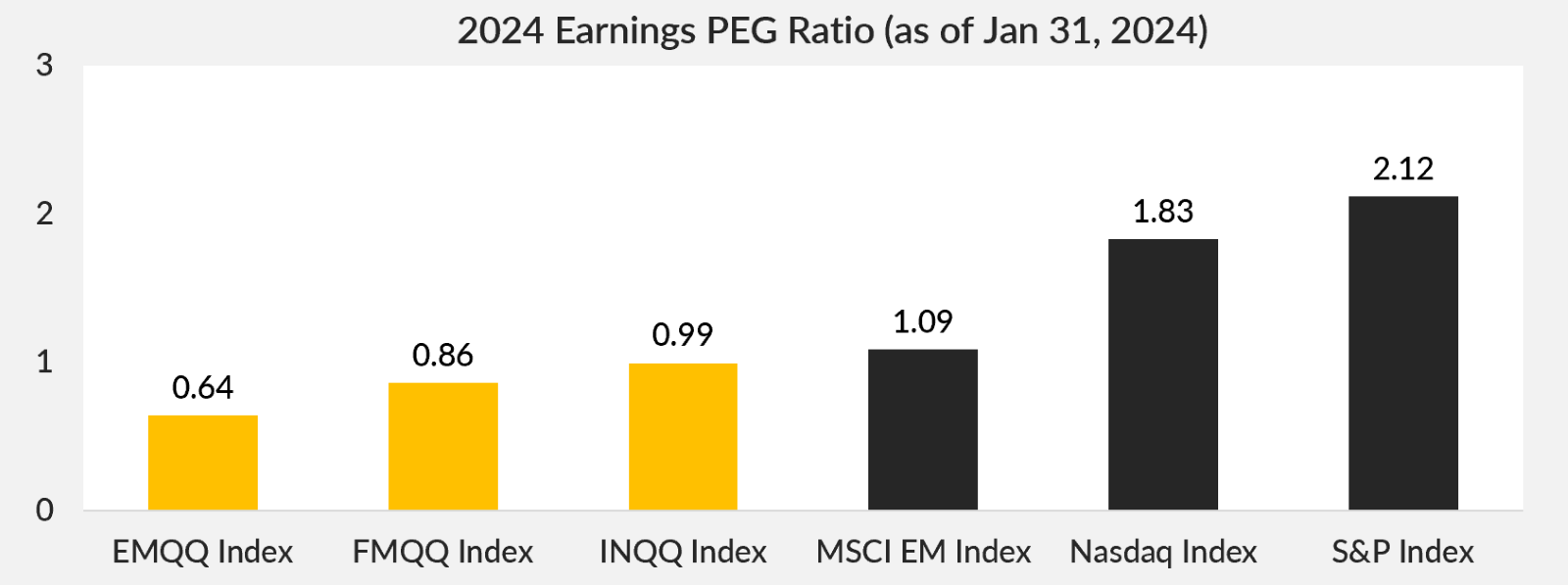

The two largest detractors for the month were Meituan and Pinduoduo, falling 23.7% and 13.3%, respectively. Despite the decline, both companies continue to exhibit strong growth rates. Meituan sales climbed 22% in the previous quarter, while Pinduoduo sales surged nearly 94%. Both also exhibited strong profit growth. Both are expected to report fourth-quarter results in the coming month.2 Meanwhile, valuations in the Chinese tech space have fallen to multi-year lows. More details on valuations are included below.3

Emerging Markets Tech News to Know

At a Glance:

-

China Signals More Stimulus

-

Alibaba Co-Founders Ramp Up Buybacks

-

India to Exceed 7% in Coming Years

-

Indian Middle-Class Set to Surge

-

Cash No Longer King in India

China Signals More Stimulus

Expectations for increased support from China to boost its economy are growing, particularly following the central bank's recent easing announcements. The People's Bank of China (PBOC) will allow banks to hold smaller cash reserves starting February 5, announced by central bank governor Pan Gongsheng. This move involves cutting the reserve requirement ratio (RRR) by 50 basis points, releasing one trillion yuan ($139.8 billion) in long-term capital into the broader economy.

Alibaba Co-Founders Ramp Up Buybacks

Alibaba co-founders Jack Ma and Joe Tsai have purchased shares worth hundreds of millions of dollars on the open market. In the fourth quarter, an entity associated with Tsai's family office, Blue Pool, acquired nearly two million Alibaba depositary shares valued at $152 million. Simultaneously, sources revealed that Jack Ma bought $50 million worth of Alibaba's stock during the same period, a renewed sign of the company’s long-term prospects.

India to Exceed 7% in Coming Years

India's Finance Ministry predicts a robust economic growth of 7% in the upcoming fiscal year, with the possibility of surpassing this rate in the following years. The ministry emphasizes the potential for sustained growth, citing the strength of the financial sector and ongoing and future structural reforms.

The government projects a 7.3% expansion in the current fiscal year, positioning India as one of the fastest-growing major economies globally. The nation's increased capital expenditure, focused on infrastructure development, a robust banking system, and healthy household savings are setting the stage for continued growth. The ministry envisions higher growth propelling India towards becoming a $7 trillion economy by 2030, up from the current $3.7 trillion.

Indian Middle-Class Set to Surge

A Goldman Sachs report predicts around 100 million people in India will become "affluent" (earning over $10,000 annually) by 2027, further fueling discretionary spending. Currently, 60 million people in India fall into this category, representing around 4% of the working-age population. The consumer market is expected to become the world's third-largest by 2027, with an increasing number of middle- to high-income households.

India's demographics play a crucial role, with around 33% of the population aged between 20 and 33, attracting global firms to expand their operations there. The growth is also reflected in increased credit card usage, doubling in the last year compared to 2019, with around 90 million credit cards in use. The focus on digitization, coupled with the confidence of the young population in India's growth story, contributes to the positive economic outlook.7

Cash No Longer King in India

India's digital payments journey began 15 years ago, with significant milestones like the introduction of the Unified Payments Interface (UPI) in 2016 and the 2016 demonetization, further accelerating the shift to digital transactions. A recent study, part of the Global Digital Shopping Index, reveals that 55% of retail purchases in India are made using digital wallets, with nearly 80% of users preferring UPI as the underlying payment method.

EMQQ Global Valuations4

Sources:

1 Bloomberg, Company FInancials

2 Bloomberg

3 Bloomberg

4 Bloomberg, EMQQ Global Analysis