EMQQ Global Performance Overview

-

The EMQQ Index declined 4.9% in November. YTD it is up 23.9%.

-

The FMQQ Index fell 3.1% for the month. YTD it is up 15.3%.

-

The INQQ Index pulled back 1.6% in November. YTD it is down -3.6%.

The leading positive contributors to performance for the EMQQ Index in November came from Brazil’s Nubank and Nexon Co, South Korea’s leading mobile gaming platform. The former received a boost from strong quarterly results, with both revenue and net income surging 39%. The company’s customer base in Latin America has climbed over 120 million after strong gains in both Brazil and Mexico. Meanwhile, Nexon benefited from strong forward-looking guidance across its mobile gaming franchise with projected revenue growth of 45-60% in the upcoming quarters.

The two largest detractors for the month were Pindudodo and Mercadolibre. China’s Pinduoduo fell on weaker-than-expected revenue growth, though earnings still rose 17%. Meanwhile, Mercadolibre reported its 27th consecutive quarter of 30% growth, although margins came in lighter than expected due to investments in logistics and other growth initiatives, both of which should continue to strengthen the company’s long-term moat.

Sources: Bloomberg, Company financials

Emerging Markets Tech News to Know

At a Glance:

-

Goldman Forecasts the Next Decade to Belong to EM

- India Delivers Blockbuster GDP Print

- Tencent’s Growth Momentum Continues

- China’s AI Models Converge with Western Counterpart

- Nubank Leverages AI to Drive Growth in Latam

- South Korea’s Naver Makes Major Move Into Crypto

-

Chart of the Month

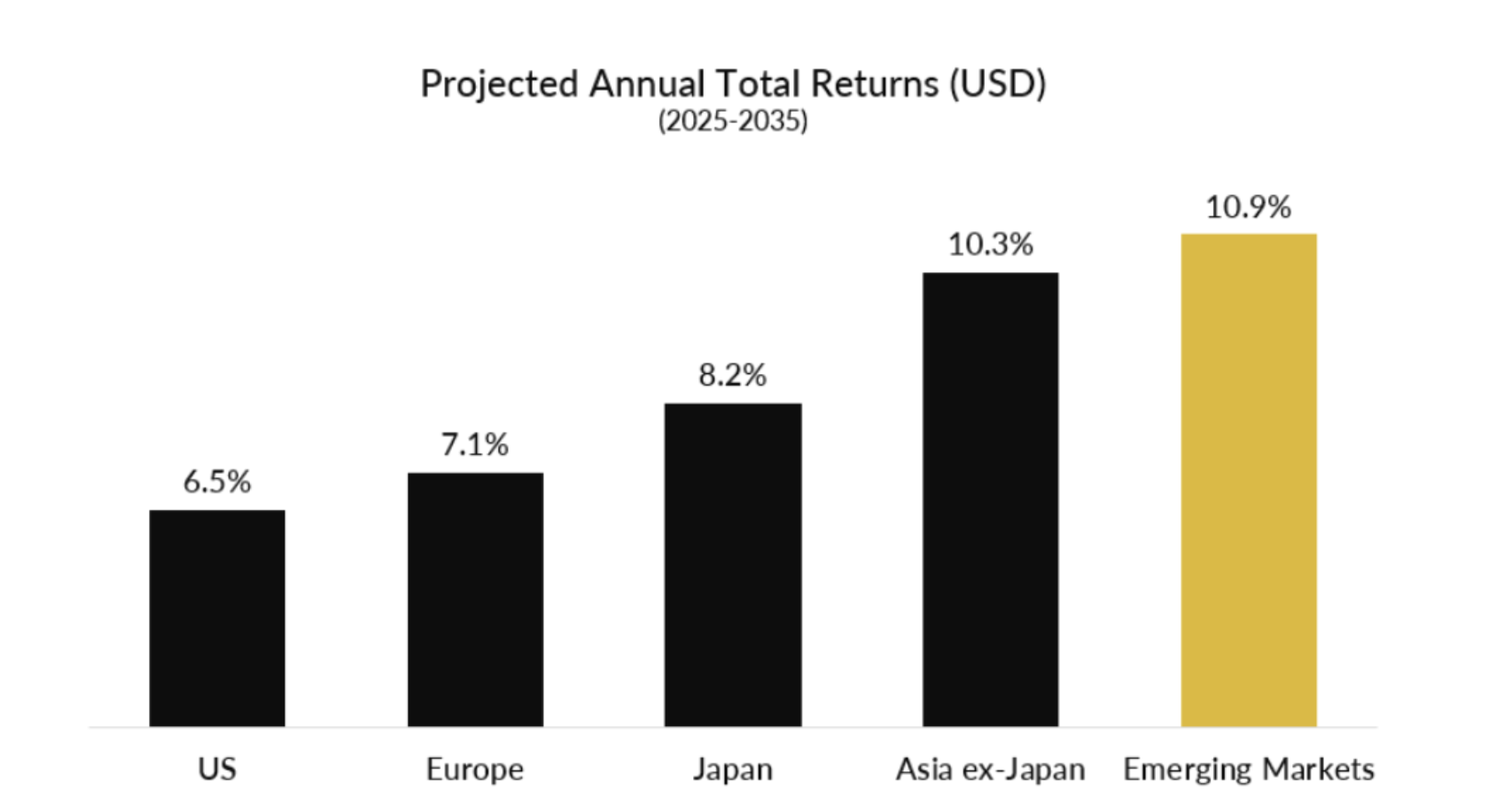

Goldman Forecasts the Next Decade to Belong to EM

Goldman Sachs’ Peter Oppenheimer projects a powerful decade ahead for emerging markets, highlighting them as the world’s most attractive equity opportunity. While elevated US valuations may cap S&P 500 returns at 6.5% annually, EM equities are forecast to deliver a robust 10.9% per year—the strongest of any region. The call comes as global markets outside the US have already outperformed in 2025, reinforcing the case for greater diversification. Goldman expects China and India to anchor EM gains through strong earnings growth, supported by higher nominal GDP expansion and ongoing structural reforms. Asia ex-Japan is also set for a standout performance at 10.3% annually. With AI benefits increasingly spreading globally rather than remaining US-centric, EM economies appear especially well-positioned. Overall, the next decade is shaping up as a major catch-up cycle for emerging markets, offering investors a compelling long-term growth runway.

India Delivers Blockbuster GDP Print

India delivered another strong economic surprise, growing 8.2% in the September quarter despite the partial impact of new U.S. tariffs. This marks an acceleration from 7.8% in the previous quarter and came in well above economists expectations. The momentum was powered by a vibrant rebound in manufacturing and construction, resilient domestic consumption, and continued double-digit expansion in financial and professional services. New Delhi’s sweeping GST cuts, along with earlier income-tax reductions, boosted household purchasing power and helped set the stage for a sharp pickup in October demand, reflected in record auto and gold sales. While external trade remains under pressure, India’s domestic engine continues to offset global headwinds, showcasing the economy’s growing self-reliance and depth. The IMF expects India to maintain robust growth in the coming years and forecasts the country will reach a $5 trillion GDP milestone by fiscal 2029 — reinforcing India’s position as one of the world’s most dynamic and resilient major economies.

Tencent’s Growth Momentum Continues

Tencent delivered a stronger-than-expected quarter, with revenue rising 15% to $27.2 billion and net income up 19%, highlighting the company’s steady momentum. Growth was powered by a standout 43% jump in international gaming revenue, reinforcing Tencent’s expanding global reach. The results show how Tencent’s disciplined, high-margin strategy—focused on integrating AI into its core businesses rather than spending heavily on infrastructure—is paying off. By embedding AI across WeChat, gaming, and entertainment, Tencent is enhancing the platforms that already anchor its enormous ecosystem. Recent gaming successes, such as Delta Force and Dying Light: The Beast, demonstrate the strength of Tencent’s in-house studios and global partnerships. Looking ahead, Tencent aims to evolve WeChat into a powerful AI-enabled assistant through its Hunyuan foundation model, positioning the company for long-term, innovation-driven growth.

Meesho Readies Milestone E-Commerce IPO in India

Meesho is preparing to become India’s first major horizontal e-commerce platform to go public. The ~$600 million IPO signals strong confidence in India’s booming e-commerce landscape. Founded in 2015, Meesho evolved from a WhatsApp-based social commerce model to a full-scale marketplace built for India’s price-sensitive consumers and small merchants, operating on a low-cost, commission-light structure. With annual transacting users reaching 234 million, Meesho reflects the massive scale of India’s digital adoption. Its public debut underscores how India’s internet economy is maturing: homegrown platforms are achieving the scale, governance, and financial discipline needed for public markets, marking a new phase of growth for the country’s online retail ecosystem.

Nubank Leverages AI to Drive Growth in Latam

Nubank delivered a strong quarter, with AI-powered credit underwriting helping boost credit-card limits, expand lending, and lift both revenue and profit. The company’s credit portfolio surged 42% to $30.4 billion, while earnings jumped 39% to $829 million—well ahead of expectations. Its new risk-analysis model, enhanced by the Hyperplane acquisition, is already proving more precise in identifying creditworthy clients, enabling faster growth without raising risk levels. Delinquencies in Brazil declined, customer additions remained robust at 4.3 million in the quarter, and Mexico is showing even stronger early-stage metrics than Brazil did at a similar scale. Nubank is also ambitiously expanding internationally, including a recent U.S. bank-charter application and investments in crypto capabilities. With AI now central to underwriting, product expansion, and customer engagement, Nubank is poised to leverage advanced machine learning to drive its next chapter of high-quality growth across Latin America.

South Korea’s Naver Makes Major Move Into Crypto

Naver Corp. agreed to acquire Dunamu, the operator of South Korea’s leading crypto exchange Upbit, in a $10.3 billion all-stock deal — a move that reshapes its role in the country’s digital-finance ecosystem. Upbit’s more than 80% market share gives Naver immediate dominance in one of the world’s most active crypto markets and provides a powerful springboard into a fast-growing new vertical. By integrating Dunamu into Naver Financial, the company transitions from a payments-focused business into a comprehensive digital-assets platform with opportunities in stablecoins, money issuance, and deeper financial services. With crypto adoption accelerating and regulatory momentum improving, the acquisition equips Naver with a major new growth engine and positions it at the forefront of South Korea’s next wave of digital innovation.

Chart of the Month

As highlighted above, Goldman Sachs projects emerging markets to lead all regions globally in terms of equity returns over the next decade, driven by strong earnings growth in both India and China.

Source: Goldman Sachs