From the bustling streets of Mumbai to the skyscraper-dotted skyline of São Paulo, a new generation of consumers are harnessing the power of the internet. The adoption of the Internet in emerging markets is revolutionizing how business is done, connecting communities, and driving unprecedented economic growth. From e-commerce giants breaking down barriers to entry for small businesses to fintech startups revolutionizing access to financial services, the potential for investment in emerging markets internet companies is vast.

As more traditional investment avenues face increasing saturation and volatility, savvy investors are turning their gaze toward the opportunities offered by these emerging markets. The allure of high growth potential, vast untapped consumer bases, and innovative business models has sparked a fervor among those seeking to capitalize on the next big trend in the global economy. Let's explore the untapped potential of investing in the rise of emerging markets internet companies.

Access the world and the future all at once.

Emerging markets are home to 85% of the world’s people and 90% of the global population under the age of 30. These young consumers are apt to embrace new technologies and have an appetite for modernization.

Capture exposure to technology as it expands.

Only 45% of people in Emerging Markets own smartphones, as compared to 77% of people in advanced economies. These phones are bringing first-time Internet access to billions of new consumers, transforming lives and economies at velocity.

Invest in economy-defining innovation.

Unencumbered by traditional retail infrastructure, technology companies in the developing world are allowing entire economies to leapfrog traditional brick-and-mortar consumption.

INVESTING IN THE RISE OF EMERGING MARKETS INTERNET COMPANIES

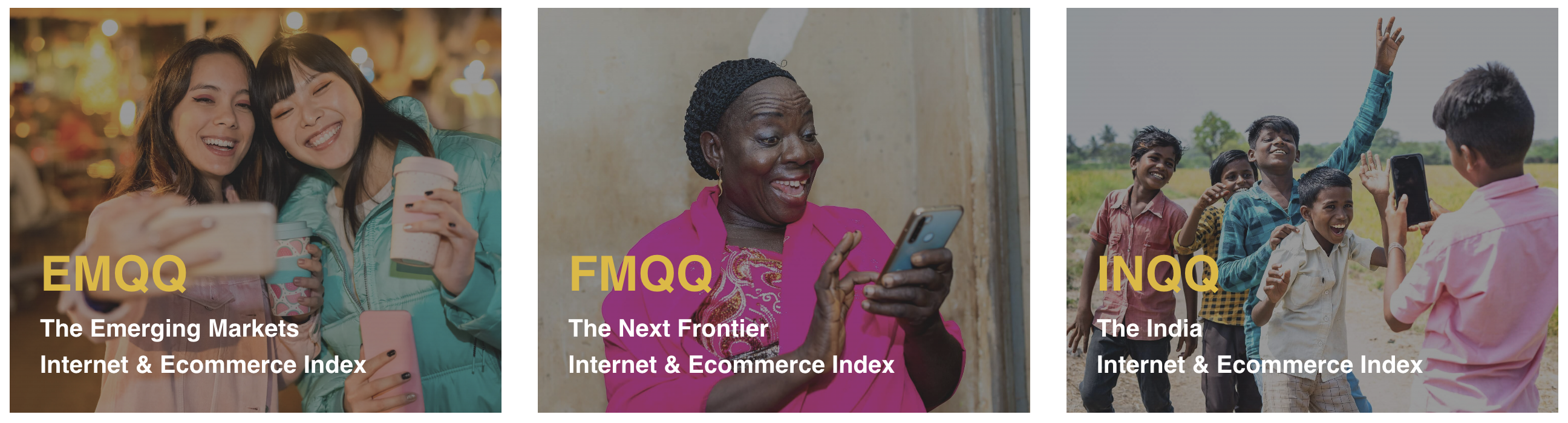

Investors can tailor their exposure to what McKinsey calls the “biggest growth opportunity in the history of capitalism" through three different EMQQ Global investment strategies.

We provide investors exposure to the rise of the smartphone-enabled emerging markets consumer. Our strategies capture the Great Confluence of 3 megatrends occurring in emerging markets across the globe:

1. a swelling middle class producing 6 billion new consumers,

EMQQ GLOBAL EMERGING MARKETS INTERNET INVESTMENT STRATEGIES

- The India Internet & Ecommerce Index (ticker: INQQ)

- The Emerging Markets Internet & Ecommerce Index (ticker: EMQQ)

- The Next Frontier Internet & Ecommerce Index (ticker: FMQQ - excludes China)